Blog written by Indu R Eswarappa, Career Coach & Education Change-Maker

When I first explored the world of taxation, I realised something powerful — tax consultants don’t just “file returns.” They help individuals and businesses stay compliant, save money legally, make informed financial decisions, and sleep peacefully knowing their finances are in order. A good tax consultant becomes a long-term advisor, problem-solver, and growth partner.

If you enjoy numbers, laws, analysis, problem-solving, and guiding people through complex systems, then understanding How to Become a Tax Consultant could open doors to a stable, scalable, and highly respected career.

In this blog, I’ll walk you through how to become a tax consultant step-by-step — from education and certifications to licensing, specialisations, income potential, and setting up your own practice. By the end, you’ll have a clear tax advisor career roadmap to decide whether this profession aligns with your strengths and long-term goals.

Key Responsibilities and Work Environment of a Tax Consultant

Tax consultancy is dynamic, advisory-driven, and constantly evolving with laws, policies, and technology. Your role changes depending on whether you work independently, with firms, or in corporate setups.

Key Responsibilities of a Tax Consultant

Tax consultants ensure compliance, optimisation, and risk management. Their core responsibilities include:

- Preparing and filing Income Tax Returns (ITR) for individuals, professionals, and businesses

- Advising clients on tax-saving strategies within legal frameworks

- Handling GST registration, returns, audits, and compliance

- Representing clients before Income Tax Authorities and GST departments

- Managing tax planning for salaried individuals, startups, SMEs, and corporations

- Advising on TDS, advance tax, capital gains, and international taxation basics

- Interpreting changes in tax laws, budgets, and notifications

- Maintaining accurate financial records and documentation

- Assisting in tax audits, assessments, and scrutiny cases

- Educating clients on compliance timelines and penalties

Work Environment of a Tax Consultant

A tax consultant can work across multiple professional environments:

1. Independent Practice / Own Firm

- High autonomy and flexibility

- Income grows with client base

- Long-term client relationships

- Scalable through team-building

2. CA Firms / Tax Advisory Firms

- Structured learning environment

- Exposure to complex cases

- Mentorship from senior professionals

3. Corporate Finance & Accounts Departments

- Fixed working hours

- Focus on compliance, reporting, and audits

- Stable income structure

4. GST Practitioner / Compliance Specialist

- High demand post-GST implementation

- Regular monthly and quarterly filings

5. Consulting & Start-up Ecosystem

- Advisory for startups, funding structures, and compliance

- Exposure to modern fintech tools

Educational Pathways and Required Qualifications

Understanding How to Become a Tax Consultant starts with choosing the right academic and certification pathway. Unlike medicine or engineering, taxation allows multiple entry routes — making it accessible and flexible.

Complete Education & Certification Roadmap for Becoming a Tax Consultant

Tax consultant course eligibility generally requires a bachelor’s degree, but certifications and diplomas allow early entry and skill-building.

Typical Skills & Personal Qualities You’ll Need

Becoming a successful tax consultant requires a blend of technical knowledge and advisory mindset.

Technical Skills Every Tax Consultant Must Build

- Strong understanding of Income Tax Act & GST laws

- Accounting and financial statement analysis

- Compliance management and documentation

- Digital filing systems and tax software

- Interpretation of circulars, notices, and amendments

Soft Skills That Shape a Successful Tax Consultant

- Analytical thinking and attention to detail

- Clear communication and client education skills

- Ethical decision-making and confidentiality

- Time management during peak filing seasons

- Continuous learning mindset

We will assess whether tax consulting truly matches your child’s thinking style, ethics, and long-term career temperament—before they commit years to the wrong path.

Career Progression: From Beginner to Trusted Tax Advisor

Your journey in How to Become a Tax Consultant evolves in clear stages.

1. Career Path After Graduation

- a) Entry-Level Roles

- Tax Assistant

- Accounts Executive

- Junior Compliance Analyst

- b) Choose Between 4 Main Routes

- Independent Tax Consultant

- CA / CMA / CS pathway

- GST practitioner pathway

- Corporate tax roles

2. Growth Opportunities at Each Stage

After Certifications

- Tax Consultant

- GST Advisor

- Compliance Manager

With Experience (5–8 Years)

- Senior Tax Consultant

- Firm Partner

- Startup & SME Advisor

Advanced Growth Tracks

- International taxation

- Forensic tax audits

- Financial advisory & wealth planning

Salary Expectations

Average Income of a Tax Consultant in India

- Entry-Level

- ₹3–6 lakhs per year

- Mid-Level (3–6 Years)

- ₹8–15 lakhs per year

- Experienced Consultant / Own Practice

- ₹20–50 lakhs+ annually

- Specialized Advisory & Corporate Clients

- ₹1 crore+ potential with strong client base

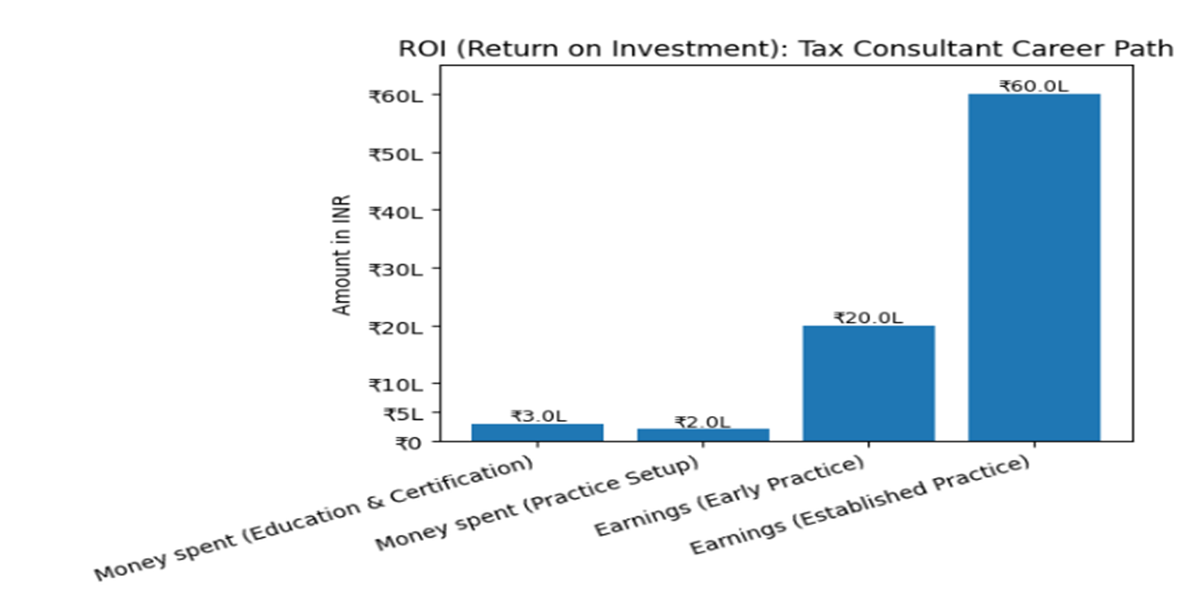

Understanding ROI and ROT in a Tax Consulting Career

ROI – Return on Investment

- Education & certification cost: ₹50,000 to ₹5 lakhs

- Practice setup: Minimal (₹1–3 lakhs)

- ROI often achieved within 2–4 years

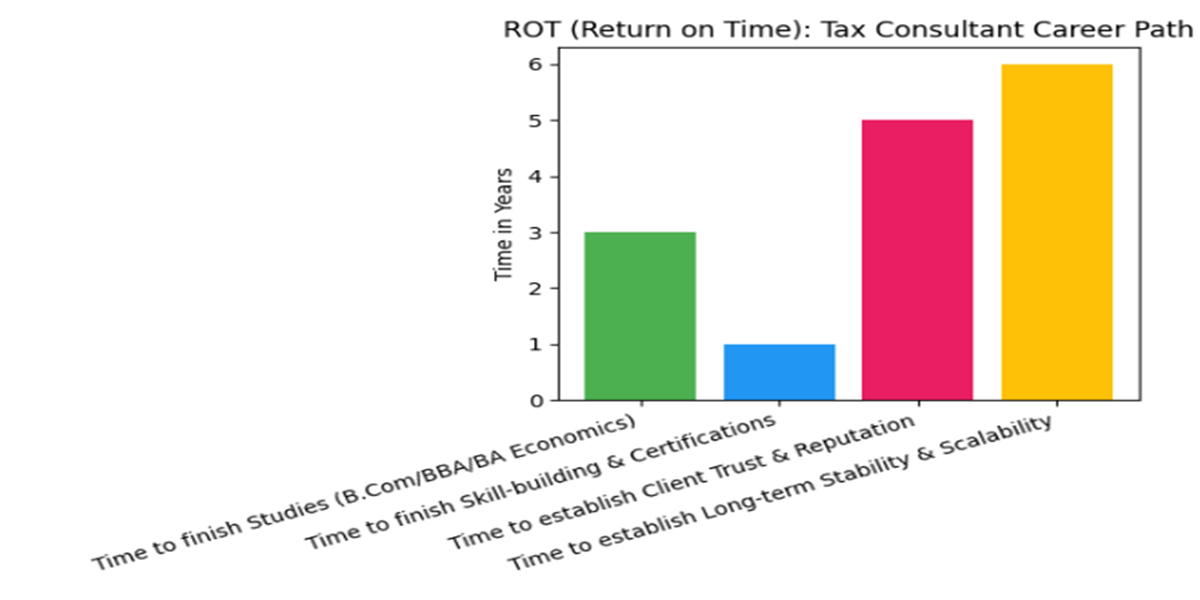

ROT – Return on Time

Skill-building Phase (1–3 years):

- Includes: Completing a Bachelor’s degree (B.Com/BBA/BA Economics), pursuing certifications or diplomas (Income Tax, GST), or starting with entry-level tax roles (Tax Assistant, Accounts Executive).

Timeframe: 1–3 years, depending on the route chosen (degree + certifications vs. immediate entry into practice).

Client Trust & Reputation Building (3–5 years):

- Includes: Gaining hands-on experience, building client relationships, refining expertise in tax laws (Income Tax, GST), and establishing a reputation for reliability.

Timeframe: 3–5 years (this phase is key for solo practitioners, while those in firms may take less time to gain client trust).

Long-term Stability & Scalability (After 5 years):

- Includes: Developing a stable client base, growing an advisory firm, offering more specialized tax advisory services (e.g., forensic tax audits, financial planning).

Timeframe: Beyond 5 years (Tax consultants who become industry leaders, specializing in high-profile advisory and wealth management).

Conclusion: Is a Career as a Tax Consultant Right for You?

Choosing How to Become a Tax Consultant means choosing a career that values trust, precision, and advisory impact. If you enjoy numbers, laws, continuous learning, and helping people make smarter financial decisions, this profession offers stability, respect, and growth.

With the right education, certifications, and guidance, you can build a scalable and future-proof advisory career.

Connect with our expert counsellors at NextMovez today and get a personalised tax advisor career roadmap based on your strengths and goals.

Let’s turn your interest in taxation into a confident, well-planned professional practice.

Resources and References

- Income Tax Department of India – https://www.incometaxindia.gov.in

- Central Board of Indirect Taxes & Customs (CBIC) – https://www.cbic.gov.in

- Institute of Chartered Accountants of India (ICAI) – https://www.icai.org

- Institute of Company Secretaries of India (ICSI) – https://www.icsi.edu

Your journey to becoming a trusted tax consultant starts with clarity — and grows with experience.