Blog written by Indu R Eswarappa, Career Coach & Education Change-Maker

I still remember the look on my cousin’s face the day she cleared her CA Final exams. After years of relentless effort, missed parties, and countless cups of chai, she was finally able to add those two coveted letters—C.A.—before her name. For many students with a commerce background, becoming a Chartered Accountant isn’t just a career choice; it’s a dream. But it also comes with a big question: How do you become a Chartered Accountant?

This guide is your all-in-one answer. Whether you’re in Class 10 figuring out future options or a B.Com student planning your next move, I’ll walk you through the steps, skills, exams, and everything in between.

Key Responsibilities and Work Environments

When students ask me “How do you become a Chartered Accountant?”, I smile—because the answer is: A lot more than just crunching numbers! The role of a CA is dynamic, impactful, and crucial to the financial well-being of businesses, individuals, and even governments.

Let’s first break down what CAs do on a daily basis, and where you might find them working.

Key Responsibilities – What CAs Actually Do?

Whether you’re working with a corporate client or an individual, a CA wears many hats throughout their career. Here are the most common responsibilities:

- Auditing and Assurance– CAs examine financial statements to ensure accuracy and compliance with regulations. It’s like being a financial detective—spotting red flags, loopholes, and ensuring transparency.

- Taxation (Direct and Indirect)– From filing returns to designing tax-saving strategies, CAs advise individuals and businesses on how to stay compliant while optimising their tax liabilities.

- Financial Reporting & Analysis- Chartered Accountants prepare detailed financial statements and analyze them to help companies make informed decisions.

- Budgeting & Forecasting – They help clients or companies plan their financial future, including preparing budgets and predicting cash flow or revenue trends.

- Internal Controls and Compliance – CAs design systems that prevent fraud and ensure processes meet financial regulations and ethical standards.

- Advisory Services– Whether it’s business expansion, mergers, or financial restructuring, CAs often serve as trusted advisors to top leadership.

Work Environments – Where CAs Build Their Careers?

Chartered Accountants can shape their careers across a variety of industries and settings. Depending on your interest and personality, here’s where you might find yourself thriving:

- Chartered Accountancy Firms – These include top-tier firms like the Big 4 (Deloitte, EY, KPMG, PwC) or mid-sized practices. You’ll often start your career here post-qualification, handling multiple client portfolios.

- Corporate Sector (MNCs, Startups, Indian Enterprises) – Many CAs work as in-house finance experts, managing budgets, compliance, and strategic financial planning.

- Banks and Financial Institutions – Roles in auditing, investment analysis, risk management, or compliance are common for CAs in the banking sector.

- Government Departments and PSUs – Through exams like UPSC or SSC, CAs can also enter public sector organizations or civil services in finance-related roles.

- Academia and Research – Some CAs transition into teaching CA aspirants, conducting training sessions, or publishing financial research.

- Independent Practice or Consultancy – Once you’ve gained experience, you can build your own CA firm or consultancy—helping clients with taxes, audits, valuations, and more.

Note: “As a CA, your skills will always be in demand. But what makes the journey truly fulfilling is when you align your technical expertise with a domain you love—whether it’s fintech, sustainability, or entrepreneurship. Your workplace can be as dynamic as your aspirations.”

Educational Pathways and Required Qualifications

If you’re wondering how to become a Chartered Accountant or how do you become a Chartered Accountant in India, it’s important to understand that there are two primary routes—based on your current level of education.

1. Foundation Route (For Students After Class 12)

This is the most common route for students who decide early on that they want to pursue Chartered Accountancy right after school.

Step-by-step breakdown:

✅ Register with ICAI for the CA Foundation Course

Once you clear Class 12 (any stream, preferably Commerce), you can register with the Institute of Chartered Accountants of India (ICAI) for the CA Foundation course.

✅ Appear for the CA Foundation Exam

This is the entry-level test that covers subjects like Accounting, Economics, and Business Law. It’s held twice a year—in May and November.

✅ Clear the CA Foundation and Register for CA Intermediate

After passing Foundation, you move on to the Intermediate level. This is a more advanced set of papers in Accounting, Taxation, Law, etc.

✅ Complete ICITSS (4 Weeks of Training)

Before you begin your practical training, you must complete ICITSS—a 4-week course in Information Technology and soft skills.

✅ Start Articleship (3-Year Practical Training)

This is one of the most crucial phases of your CA journey. You’ll work under a practicing CA to gain hands-on experience in audits, taxation, and financial analysis.

✅ Register and Prepare for CA Final

During or after your Articleship, you’ll register for the CA Final exams—the last stage before qualification.

✅ Pass the CA Final Exam and Get Certified

Once you pass the Final exams and complete your Articleship, you’re officially a Chartered Accountant!

2. Direct Entry Route (For Graduates and Postgraduates)

If you didn’t pursue CA immediately after school, don’t worry. The Direct Entry Route is tailor-made for graduates who decide to become a CA a bit later.

Eligibility Criteria:

- Commerce Graduates with minimum 55%

- Non-Commerce Graduates with minimum 60%

Steps in the Direct Entry Route:

✅ Directly Register for CA Intermediate

You get to skip the Foundation level and jump straight to Intermediate.

✅ Complete ICITSS (4 Weeks)

Before you begin practical training, ICITSS is mandatory—just like in the Foundation Route.

✅ Start Articleship (3 Years)

The same 3-year training applies here, giving you real-world experience under a CA firm or practitioner.

✅ Register and Appear for CA Final

Post-Articleship, you’ll attempt the Final exams.

✅ Qualify and Become a CA

Clear both groups of the Final exam and fulfill the training requirements—you’re now a Chartered Accountant!

Tip: Whether you take the Foundation Route or Direct Entry Route, the real secret to success lies in your consistency, curiosity, and commitment to learn beyond the textbooks.

Entrance Exams to Watch Out For

Tip: Always keep an eye on ICAI’s official site for updated schedules and eligibility rules.

Soft Skills & Technical Abilities You’ll Need

Whenever I coach aspiring CAs, I remind them—it’s not just your exam rank that defines your success in this field. The real edge comes from how well you combine your technical mastery with real-world soft skills. If you’ve ever wondered how to become a Chartered Accountant, know that passing the exams is just one part of the journey. How do you become a Chartered Accountant who actually thrives? By mastering the mindset, discipline, and communication skills needed for the real world.

Let’s break down the essential skillsets that help you not just qualify as a CA, but thrive in your career.

Soft Skills – The Human Side of Finance

- Attention to Detail

In finance, a single misplaced digit can turn a profit into a loss. Being meticulous is non-negotiable when you’re dealing with audits, tax returns, or balance sheets. - Communication

You might be brilliant with numbers, but can you explain a tax strategy to a non-finance CEO? Clear, confident communication builds trust and makes you a true advisor. - Ethics & Integrity

As a CA, you’re not just keeping books—you’re safeguarding financial transparency. Clients trust you with sensitive data, and ethical judgment is your true compass. - Time Management

Multiple audits, tax deadlines, client meetings—it’s a constant juggle. Your ability to prioritize and deliver on time will earn you a stellar reputation.

Technical Abilities – Your Core Toolkit

- Proficiency in Accounting Software (Tally, SAP, Zoho, QuickBooks)

These tools are the backbone of everyday accounting work. Being comfortable with different platforms keeps you agile in any work environment. - GST, TDS, and Tax Filing Knowledge

Staying updated with India’s evolving tax landscape is a must. From filing returns to advising on compliance, tax knowledge is your bread and butter. - Audit Procedures and Financial Statement Analysis

Understanding how to conduct audits and read deep into financial reports sets you apart from bookkeepers and makes you invaluable to any firm. - Advanced Microsoft Excel Skills

Excel is your daily companion. Beyond basic formulas, you’ll need to master pivot tables, macros, data modeling, and dashboards to work like a pro.

Note: “Your CA designation will open doors. But it’s your ability to manage pressure, deliver insights, and lead with ethics that will define your long-term success. So start building these skills as early as possible—they’re your secret career currency.”

Career Progression & Growth Opportunities

One of the things I love most about the Chartered Accountancy path is how dynamic and versatile it is. Whether you’re someone who enjoys deep-diving into numbers or someone who dreams of running your own firm one day, there’s room to grow and shine. Many students ask me how to become a Chartered Accountant, but I always remind them—the real question is, how do you become a Chartered Accountant who stands out in a competitive world? I often tell my students—becoming a CA isn’t the finish line, it’s the launchpad.

Let’s walk through the different stages of your CA journey and the exciting roles you can explore along the way.

Entry-Level – Where You Learn the Ropes

- Audit Assistant

- Junior Accountant

- Tax Associate

This is your hands-on training ground. You’ll support audit teams, prepare basic financials, and help with compliance. These roles sharpen your technical skills and introduce you to real-world client challenges.

Mid-Level – Gaining Authority and Independence

- Financial Analyst

- Internal Auditor

- Tax Consultant

By now, you’ve built a strong foundation. At this stage, you start offering strategic insights, conduct internal audits, and manage client portfolios. Your voice starts to matter in boardrooms.

Advanced – Leading, Innovating, Building Legacies

- Chief Financial Officer (CFO)

- Finance Controller

- Independent Practice, ICAI Faculty

With years of experience and a solid reputation, you can head finance departments, launch your own consultancy, or give back by teaching future CAs. You’re not just working in the system—you’re shaping it.

Specializations – Carving Your Niche

- Forensic Accounting

- International Taxation

- Mergers & Acquisitions

If you love to specialize, CA has endless options. You could trace financial fraud, advise global clients on tax, or work on billion-dollar business deals. Your niche becomes your brand.

Advice: “No matter where you start, the CA designation puts you on a path of lifelong learning and leadership. Don’t rush the journey—each phase builds the expertise and reputation that’ll set you apart in the long run.”

Dreaming of a CA career?

ROI: Is Becoming a Chartered Accountant Worth It?

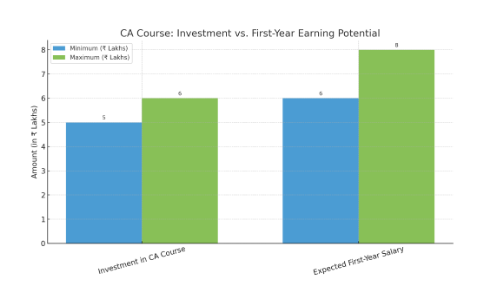

When students (and often their parents) ask me “Is all this effort really worth it?”, I always say—Absolutely, yes. The Chartered Accountancy journey might be intense, but the Return on Investment (ROI) is one of the best among professional courses in India.

Let’s break it down:

- Low Course Fees, High Rewards – Although ICAI’s official costs—including registration, exams, and study materials—come to about ₹2–2.5 lakhs, most students also choose to take private coaching at various stages (Foundation, Intermediate, and Final). Depending on the city, whether classes are online or offline, and the institute chosen, coaching can add another ₹2.5–4 lakhs to the total expense. Thus, Estimated Total Investment: ₹5–6.5 lakhs. Still a much more cost-effective option compared to an MBA or many international finance certifications!

- Lucrative Starting Salaries – As a freshly qualified CA, you can expect starting packages ranging from ₹7–10 LPA in top firms, and even higher in multinational companies or international placements.

- Fast Career Growth – With 3–5 years of experience, you can move into mid-level roles with ₹12–20 LPA packages. Eventually, senior roles like CFO or Partner can exceed ₹40–50 LPA.

- Job Security & Global Demand – Every business needs finance experts. CAs enjoy strong demand across sectors—from startups to Fortune 500 companies.

Average Salaries

Stage | Monthly Salary |

Fresher (Post CA) | ₹50,000 – ₹80,000 |

Mid-Level (5–7 yrs) | ₹1 – ₹2.5 lakhs |

Senior/Partner Level | ₹3 – ₹5 lakhs+ |

Abroad (Big 4, MNCs) | ₹5 – ₹10 lakhs/month |

ROT: Is the Time You Invest Worth It?

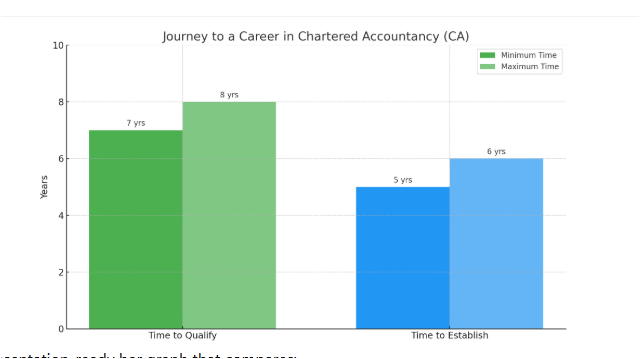

Now let’s talk about the other side of the coin—Return on Time (ROT). Because becoming a Chartered Accountant isn’t just a financial investment—it’s a big commitment of time, energy, and focus.

Many students ask me: “Is it worth spending 4–5 years of my life preparing for this?” And my answer is: Yes—but only if you’re ready to give it your all.

Here’s why it’s still a strong ROT:

- Time Span: 4–5 Years – Most students complete the CA journey in 4.5 to 5 years, including the 3-year articleship. While that’s a long haul, it gives you both deep knowledge and on-the-job experience.

- No Wasted Effort – Even if you face a few setbacks or take longer to clear exams, everything you learn—accounting, law, taxation, audit—is 100% relevant in your future career.

- Early Career Advantage – By the time you qualify, you’re already 2–3 years into real work experience. That’s a head-start many MBAs or other professionals don’t have.

- Long-Term Payoff – A CA typically recovers the time invested within the first 2–3 years of full-time work. After that, it’s pure acceleration.

In just about 5–6 years, you’re ready to earn like a boss and build a respected professional brand.

Final Takeaway

The road to becoming a Chartered Accountant is intense—but it’s also deeply rewarding. If you’ve ever asked yourself, “How do you become a Chartered Accountant?”—the answer lies in discipline, focus, and smart strategy.

And remember, you’re never alone on this path. Whether it’s prep tips, motivation, or mapping out your next step, I’m here to guide you.