As a parent, I’ve often found myself wondering, “Is finance the right path for a teenager?” Especially if your child is inclined toward numbers, analysis, or even simply curious about how businesses and money work, then this is a question worth exploring deeply.

The finance career path isn’t just about banking or accounting anymore — it’s a dynamic, evolving space with opportunities in fintech, wealth management, global trading, and corporate leadership. But how do we know if our child fits this path? And if they do, how early should we start preparing?

Let me walk you through everything I’ve learned while guiding students and families through this journey.

Finance As A Career

Finance is more than just a career — it’s a gateway into the heart of the global economy. Professionals in finance help individuals, businesses, and governments manage money, invest wisely, reduce risks, and plan for the future. With the rise of startups, stock markets, and cryptocurrencies, a finance career path is now more lucrative and diverse than ever.

Key Responsibilities & Work Environment

A career in finance offers a dynamic mix of analytical tasks, strategic decision-making, and real-world impact. Whether it’s managing investments, analyzing risks, or preparing financial reports, finance professionals play a crucial role in helping organizations and individuals make smart money decisions. The work environment can range from high-energy trading floors to corporate offices or even remote consulting setups, depending on the chosen role and specialization.

Depending on the specialization, finance professionals might:

- Analyze financial data and trends – Interpret market patterns and company performance to guide financial decisions.

- Offer investment or risk management advice – Help clients or companies make informed choices on where and how to invest.

- Manage portfolios and budgets – Oversee financial plans, ensuring resources are allocated efficiently and goals are met.

- Handle auditing and compliance – Ensure financial practices follow legal regulations and maintain transparency.

- Work on mergers, acquisitions, or venture capital deals – Evaluate business opportunities and negotiate deals to drive growth.

Work environments vary — from fast-paced trading floors and corporate boardrooms to consultancy firms and remote data analysis roles.

- Trading Floors – High-pressure, fast-paced environments where quick decisions and real-time market monitoring are key.

- Corporate Boardrooms – Strategic roles focused on financial planning, forecasting, and big-picture decision-making.

- Consultancy Firms – Client-focused settings where professionals offer financial advice, audits, and investment planning.

- Remote Data Analysis Roles – Flexible, tech-driven jobs involving analyzing financial trends and preparing reports from anywhere.

If your child enjoys solving problems, making data-driven decisions, or keeping up with business news, these tasks might actually excite them!

Educational Pathways & Required Qualifications

To step confidently into the finance careers path, your child needs a strong academic foundation paired with the right qualifications. Starting from the high school level and progressing through undergraduate and optional postgraduate studies, each step builds expertise in handling money, markets, and strategy.

High School (Grades 11–12): Choose the Commerce stream with subjects like Accountancy, Business Studies, Economics, and Mathematics to build a solid base.

Undergraduate Degree Options:

- B.Com (General or Honors): Offers a broad understanding of commerce, finance, and accounting principles.

- BBA in Finance: Focuses on business management with a strong emphasis on financial planning and analysis.

- BA in Economics: Ideal for students interested in financial systems, policy, and market behavior.

- Bachelor’s in Accounting or Financial Management: Sharpens technical skills in managing corporate or personal finances.

Postgraduate or Specialized Studies (optional but advantageous):

- MBA in Finance: Equips students for leadership roles in corporate finance, banking, and investment.

- M.Com: Deepens knowledge in finance, taxation, and business laws.

- Chartered Financial Analyst (CFA): Globally respected credential for careers in investment banking, portfolio management, and equity research.

- Certified Public Accountant (CPA): International certification ideal for accounting and auditing careers, especially abroad.

Entrance Exams

To enter top-tier colleges and kickstart a successful finance careers path, students must often clear entrance exams after Grade 12. These exams are designed to test aptitude, reasoning, and subject knowledge and they vary based on the college or university. Preparing early can give your child a strong edge in securing a seat in prestigious institutions.

For certifications like CFA or CPA, students can apply post-graduation or with specific credit requirements.

Necessary Soft-Skills & Technical Abilities

In today’s highly competitive finance world, having textbook knowledge alone won’t cut it. To truly thrive in a finance careers path, students must cultivate a well-rounded skill set—blending strong soft skills with practical technical abilities. Here’s a breakdown of what matters most:

Soft Skills

- Analytical Thinking

The ability to break down complex financial problems and spot patterns in data is crucial for roles in investment banking, auditing, or financial planning. - Communication Skills

Finance professionals must explain complex numbers in simple terms to clients, stakeholders, or team members—both in writing and in conversation. - Decision-Making Under Pressure

Quick, informed decisions are often required in fast-paced environments like trading, mergers, or crisis management. - Ethical Reasoning

Integrity is non-negotiable in finance. Professionals are expected to make decisions that comply with legal standards and ethical guidelines. - Attention to Detail

One decimal point can make a big difference. Precision in data entry, analysis, and reporting can save companies from costly mistakes.

Technical Abilities

To thrive in today’s finance landscape, young professionals need a powerful blend of traditional tools and emerging AI-driven technologies. Here’s a breakdown of the key technical skills:

Excel Proficiency

Advanced Excel skills—think pivot tables, macros, and VLOOKUP—are still foundational. They’re essential for building financial reports, dashboards, and running complex calculations. Tools like Microsoft Copilot now supercharge Excel by using AI to auto-generate summaries, charts, and even financial models.

Financial Modeling

The ability to build dynamic financial models to predict future performance or evaluate investment opportunities gives finance professionals a major edge. Today, this is enhanced by AI-powered platforms such as Google AutoML, H2O.ai, and DataRobot, which automate complex forecasting and scenario planning tasks.

Data Analysis Tools (R, Python, SQL)

Finance is increasingly data-driven. Skills in R, Python, and SQL allow professionals to analyze large financial datasets, detect trends, and make informed decisions. These tools are also the backbone of quantitative finance, fintech innovation, and risk analytics.

Generative AI for Finance

AI tools like ChatGPT, Claude, and Copilot are transforming finance tasks:

- Auto-generate financial summaries and reports

- Analyze earnings call transcripts for sentiment and strategy insights

- Draft investment memos or presentations

- Use prompt engineering to extract insights from large datasets and automate compliance reports

RPA and Finance Automation

Robotic Process Automation (RPA) tools such as UiPath and Blue Prism automate repetitive and rules-based tasks like:

- Bank reconciliations

- Invoice processing

- Regulatory compliance reporting

This saves time and reduces manual errors in high-volume operations.

Knowledge of Financial Software (Tally, SAP, QuickBooks)

Hands-on experience with Tally, SAP, Zoho Books, or QuickBooks is valuable for roles in accounting, auditing, and enterprise finance. These platforms are evolving too—with AI-powered modules that offer smart forecasting and anomaly detection.

Career Progression & Growth Opportunities

One of the things I love about the finance career path is how it rewards consistency and curiosity. Whether your child starts as an analyst or accountant, there are so many directions they can grow into—each with its own set of rewards and impact. Let’s look at how this path typically unfolds:

Entry-Level Roles

- Junior Analyst – Supports data collection and prepares basic financial reports under supervision. A great start to understanding market patterns and company finances.

- Assistant Accountant – Handles day-to-day accounting tasks like ledgers, invoices, and reconciliations—building the foundation for bigger responsibilities.

- Audit Associate – Works with auditors to verify records and ensure compliance. Ideal for students who love details and structure.

Mid-Level Roles

- Financial Analyst – Evaluates financial data to guide strategic business decisions. This role demands both number skills and business insight.

- Credit Manager – Assesses creditworthiness of clients and manages credit risk—critical in banks and financial institutions.

- Tax Consultant – Advises clients or companies on tax planning and helps them comply with tax laws efficiently.

Senior Roles

- Finance Manager – Oversees budgeting, forecasting, and financial performance. A leadership role that shapes company strategies.

- Chief Financial Officer (CFO) – Heads the finance department and works directly with CEOs to drive financial health and investor confidence.

- Investment Banker – Facilitates big financial deals like IPOs and mergers. Fast-paced and high-stakes!

- Portfolio Manager – Manages client or corporate investment portfolios with a goal to maximize returns while managing risks.

Specialist Roles

- Actuary – Uses math and statistics to assess financial risks, often in insurance or pensions. Great for math lovers!

- Risk Analyst – Identifies potential financial risks and suggests strategies to minimize losses.

- Blockchain Finance Expert – A cutting-edge role in fintech, focusing on crypto assets, smart contracts, and decentralized finance systems.

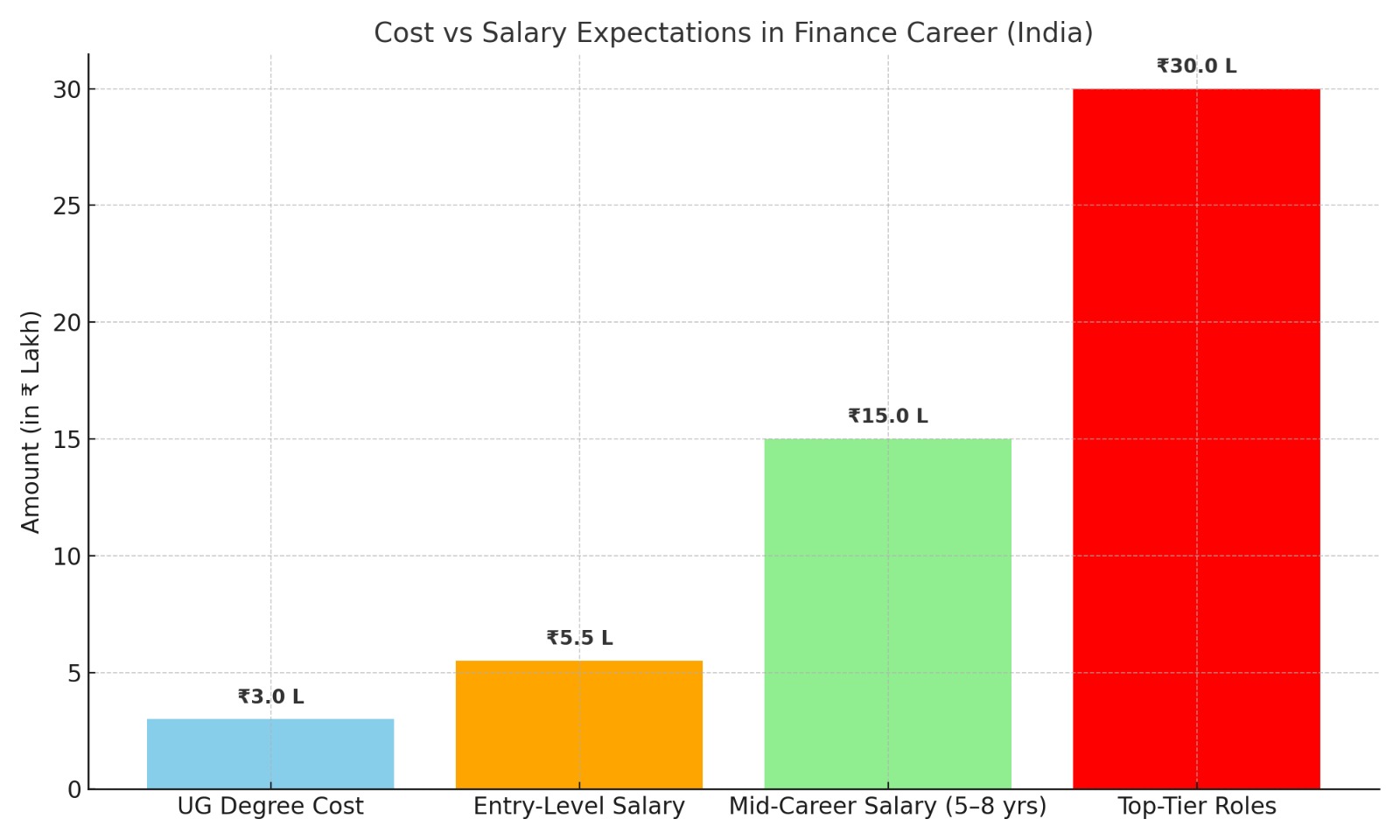

Return on Investment (ROI) – Is a Finance Career Worth the Money?

When evaluating a career, one big question looms: “Will the money I invest in education come back to me?” In finance, the answer is typically yes — often sooner than expected.

Entry-Level Salaries (₹4–7 LPA approx)

Freshers starting as analysts, junior accountants, or associates in metro cities or global firms earn competitive packages. Strong internships, certifications (like CFA/CPA), or Excel and data skills can nudge this higher.

Mid-Career Growth (₹10–20 LPA approx)

With 5–8 years of experience, professionals who pursue a specialization or MBA often unlock senior roles with much better compensation — think finance managers, business controllers, or strategy leads.

Top-Tier Roles (₹30+ LPA or $100,000+ globally)

Finance leaders — such as CFOs, Investment Bankers, Fund Managers, or Risk Heads — command high salaries in both Indian and international markets (US, UK, Singapore, Dubai).

Summary:

- Low educational cost compared to medicine/law

- High earning potential within 5–10 years

- Global job mobility with scalable skills

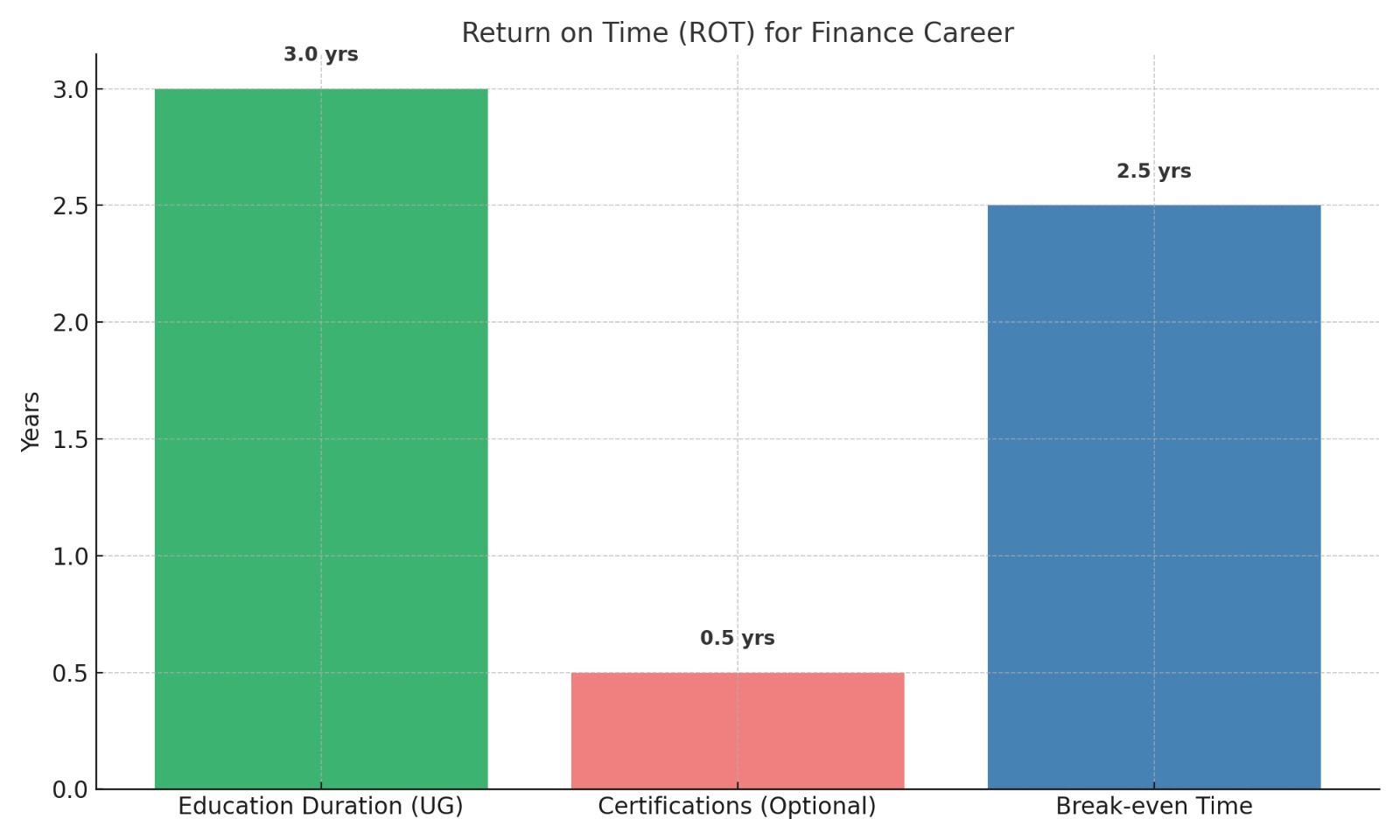

Return on Time (ROT) – How Soon Can My Child See Results?

Unlike careers that require 7–10 years of study before real-world income starts, finance offers faster entry and earlier ROI.

Shorter Education Path

- Many finance roles are accessible with a 3-year degree (B.Com, BBA) + certification (CFA/CPA/FRM)

- No need for NEET, CLAT, or long postgrad prep

Faster Workforce Entry

- Students can begin internships by 2nd year

- Job-ready skills in tools like Excel, Python, or QuickBooks speed up hiring

- Entry-level roles often start immediately after graduation

Early Promotions

- Promotions and salary hikes are performance-based, not just time-based

- Some professionals move to managerial roles within 3–5 years

Summary:

- Faster earning curve

- No long prep years

- Early exposure through internships, case competitions, or NSE/SEBI programs

Conclusion: Is Finance the Right Path for Your Child?

As a career mentor and a parent myself, I’ve seen firsthand how the finance careers path can transform a student’s future — not just in terms of salary, but also in confidence, global exposure, and decision-making skills. The field is broad, future-ready, and bursting with opportunities for those who are curious, analytical, and driven.

But here’s the real deal: finance isn’t just about numbers — it’s about strategic thinking, understanding human behavior, and making decisions that shape businesses and economies. If your child enjoys solving problems, asking “why,” and seeing the bigger picture, this path can be incredibly fulfilling.

Takeaway: Help your child build a strong foundation in commerce subjects early on, encourage real-world exposure through internships, and nurture both their technical and soft skills. Finance rewards those who are both smart and self-aware.

And if you’re still wondering whether this fits your child’s personality or aptitude — reach out to NextMovez. Let’s figure it out together.

Resources & References Used

- NSE India: https://www.nseindia.com

- CFA Institute: https://www.cfainstitute.org

- CUET Official Website: https://cuet.samarth.ac.in