Blog written by Indu R Eswarappa, Career Coach & Education Change-Maker

When I first started guiding students curious about finance, I noticed one career question that always lit up the room: “How do I become an investment banker?” For many, the role carries a certain mystique—glamorous boardrooms, high-stakes deals, and financial rewards that often make headlines. But behind the prestige lies a demanding, structured, and incredibly rewarding career path.

If you’ve ever been the one in your group who naturally handles budgeting for events, enjoys analyzing numbers, or is fascinated by how global markets work, you may already have the makings of an investment banker. Becoming one is not just about money; it’s about problem-solving, strategy, and helping businesses grow.

In this blog, I’ll walk you step by step through how to become an investment banker—from qualifications, entrance exams, and essential skills to the growth trajectory, salary expectations, and return on investment (ROI). By the end, you’ll know whether this dynamic, high-pressure, and high-reward career is the right fit for you.

Key Responsibilities and Work Environment

When I mentored a student who joined an investment bank in Mumbai, she described her first week as “a crash course in both finance and patience.” Her day began with analyzing financial models, then moved to client meetings, and often ended late at night preparing pitch books for the next day. The work is intense, but for those who thrive on challenge, it’s unmatched in excitement.

Key Responsibilities of an Investment Banker

- Advising on Mergers & Acquisitions (M&A)

Helping companies buy, sell, or merge businesses to maximize value. - Fundraising & Capital Raising

Structuring IPOs, bonds, or private placements to help businesses raise money. - Financial Modeling & Valuation

Building complex models to assess company worth and predict market outcomes. - Client Relationship Management

Working with CEOs, CFOs, and investors to advise on financial strategies. - Market Research & Analysis

Tracking industry trends, stock performance, and economic movements to inform deals.

Work Environment

Investment banking is fast-paced, global, and competitive. Most bankers work in major financial hubs like Mumbai, London, New York, or Singapore. The environment is:

- High-pressure: Long hours (80–100 per week is not uncommon early on).

- Team-driven: Working closely with analysts, associates, and senior bankers.

- Client-focused: Every presentation, model, or strategy is tied to high-stakes decisions.

If you love adrenaline, problem-solving, and numbers, this environment will both challenge and reward you.

Educational Pathways and Required Qualifications

When I guide students toward this path, the biggest myth I break is—“You need to be a math genius to become an investment banker.”

❌ Not true. What you really need is a sharp mix of financial literacy, strategic thinking, and emotional intelligence.

Counterintuitive truth: In the AI era, soft skills like persuasion, storytelling, and client empathy may outpace technical modeling within five years.

Investment banking is shifting from pure number-crunching to narrative-driven influence — where your ability to explain a deal, build trust, and see patterns machines can’t, will set you apart.

Try This:

Explore how tools like ChatGPT or Excel Copilot simplify financial analysis. Then ask yourself — can I make sense of the “why” behind the numbers? That’s where real bankers thrive.

Breaking into investment banking usually requires a solid academic foundation in finance, economics, or business. According to the AICTE Guidelines on MBA and Finance Programs (2024), specialized postgraduate degrees in finance, investment management, or financial analytics significantly improve employability in global banking firms.

The UGC Curriculum Framework for Higher Education 2024 also emphasizes interdisciplinary finance learning, integrating AI, data analytics, and sustainability—reflecting how the future of finance education is evolving in India.

Here’s your roadmap from school to global investment banks:

Tip: While an MBA is the most common path, CFA + strong internships can also open doors to global banks

Necessary Soft Skills and Technical Abilities

When I first met an investment banker during a campus seminar, I expected him to talk only about numbers, balance sheets, and financial jargon. But what struck me most wasn’t just his sharp technical knowledge—it was his ability to explain complex financial strategies in such a clear, persuasive way that even students from non-finance backgrounds were hooked. That’s when I realized: investment banking isn’t just about crunching numbers, it’s about combining financial expertise with people skills.

The role is no longer just about crunching numbers—it’s about combining technology, analysis, and communication. According to the World Bank Global Financial Development Report (2024), emerging markets like India are seeing a rise in fintech-driven investment roles, requiring bankers to master data visualization tools and algorithmic insights.

As an aspiring investment banker, you’ll need this unique blend too. Your technical toolkit—valuations, Excel modeling, financial statements—will give you the foundation. But your soft skills—like negotiation, communication, and resilience—will determine how effectively you pitch deals, manage client relationships, and navigate high-pressure boardrooms.

Think of it this way: technical abilities get you the seat at the table, but soft skills keep you in the room. Let’s look at the core skills that make investment bankers stand out, and why they matter for your career journey.

Soft Skills

- Analytical Thinking – Spotting insights in financial data.

- Communication & Persuasion – Pitching deals to high-profile clients.

- Resilience – Thriving under pressure and long work hours.

- Networking & Relationship-Building – Deals often depend on trust and connections.

Technical Abilities

- Excel & Financial Modeling – Building and analyzing financial models.

- Valuation Techniques – DCF, comparable company analysis, precedent transactions.

- Knowledge of Markets – Stocks, bonds, derivatives, global economics.

- Data & Tools – Bloomberg, FactSet, Capital IQ, Python for finance.

Why it matters: Banks don’t just hire “number crunchers”—they hire problem-solvers who can turn financial data into strategic decisions.

Career Progression and Growth Opportunities

When I spoke to a young analyst who had just entered investment banking, he described his life as “long nights, steep learning curves, and an adrenaline rush with every deal.” A few years later, when I caught up with him again, he wasn’t just crunching spreadsheets anymore—he was leading client meetings, closing multi-million-dollar transactions, and mentoring juniors who were once in his shoes.

Investment banking continues to be one of the most competitive yet rewarding fields in global finance. The LinkedIn Jobs on the Rise 2025 Report highlights that demand for financial analysts, investment associates, and M&A professionals in India has grown by over 37% in the last two years, driven by startup funding and cross-border deals.

That’s the beauty of investment banking—it’s one of the few careers where growth is almost built into the journey. You start at the ground level, learning the ropes with intense detail-oriented work. Over time, as you prove your expertise and resilience, you climb into roles where you’re not just analyzing numbers—you’re influencing boardroom decisions and shaping financial strategies for global businesses.

Typical Career Path in Investment Banking

- Analyst (0–3 years): Entry-level role; heavy on research, modeling, and presentations.

- Associate (3–6 years): Manages analysts, works directly with clients.

- Vice President (6–10 years): Leads deal execution and client relationships.

- Director/Executive Director (10–12 years): Brings new business, mentors juniors.

Managing Director (12–15+ years): Highest leadership; drives multi-million-dollar deals.

The AI Shift in Finance

Just like AI transformed HR, it’s reshaping investment banking too. AI handles data-heavy tasks like market research, due diligence, and risk modeling. This allows bankers to focus on strategy, relationship management, and complex negotiations. Those who adapt to AI tools will future-proof their careers.

McKinsey’s The Race to Deploy AI and Raise Skills discusses that by 2030, “up to 30 percent of current hours worked could be automated, accelerated by generative AI. This shift will demand professionals who understand not just finance, but also ethical AI, data interpretation, and global compliance frameworks.

To stay ahead, students should certify in AI and Python for finance, and explore FinTech analytics programs offered by leading institutions such as CFA Institute and AICTE-accredited universities.

Salary Expectations and ROI

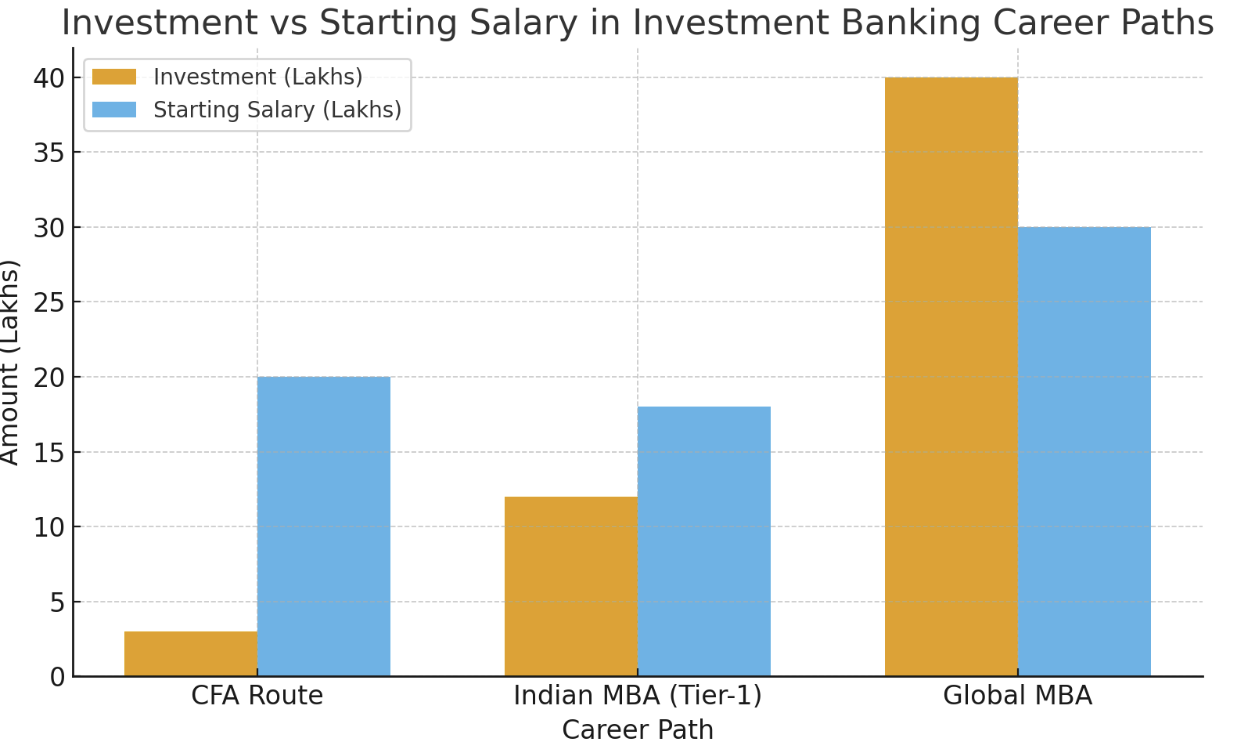

One of the biggest motivations for students is the financial reward. So, let’s answer: Is investment banking financially worth it?

Compensation in investment banking reflects both responsibility and impact.

As per the RBI Annual Report on the Indian Banking Sector (2024), financial sector wages in investment banking and private equity have grown by 12–15% annually—outpacing most corporate roles.

In global markets, the CFA Institute’s 2024 Compensation Study reveals that analysts and associates earn USD 100K–150K on average, with bonuses linked to deal success and performance.

Average Salaries in India (2025 data – Glassdoor, AmbitionBox)

- Analyst (0–3 years): ₹10 LPA – ₹20 LPA

- Associate (3–6 years): ₹25 LPA – ₹45 LPA

- Vice President (6–10 years): ₹50 LPA – ₹90 LPA

- Managing Director (15+ years): ₹1 Cr+ annually

In global hubs (US, UK, Singapore), salaries are often 2–4x higher, with bonuses sometimes exceeding base pay.

ROI of Becoming an Investment Banker

- High Earning Potential – Among the highest-paying finance careers.

- Global Mobility – Degrees/certifications like MBA & CFA open international roles.

- Career Longevity – While demanding, the skills transfer into private equity, VC, consulting, or entrepreneurship.

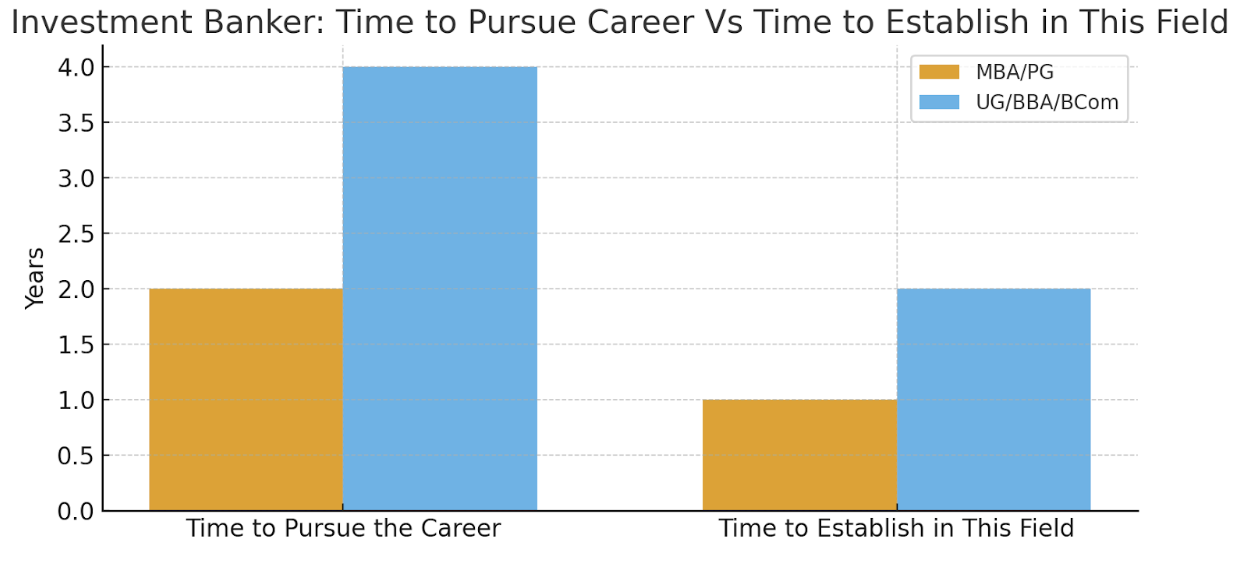

Return on Time (ROT): Investment Banking Path

Here’s what the time investment vs. time to establish looks like:

- Education: 3–5 years (UG) + 2 years (MBA)

- Early Career: 3 years to prove credibility as Analyst

- Mid-Career: 5–6 years to become VP

- Senior Career: 12–15 years to reach MD level

Conclusion: Is Investment Banking the Right Path for You?

Becoming an investment banker is not just about making money—it’s about building financial strategies that impact companies, industries, and economies. It demands long hours, resilience, and sharp skills, but the rewards—global careers, financial freedom, and leadership opportunities—make it one of the most aspirational career paths today.

For parents, encouraging your child toward investment banking means supporting a career of prestige, global demand, and high growth. For students, it’s about committing to both technical mastery and personal discipline.

Take this example:

One parent once worried about their teen’s potential long hours in investment banking. Through NextMovez coaching sessions, we used the Career Clarity Compass™ to align the student’s dream of deal-making with the family’s core values of balance and integrity. The result? Clarity, confidence, and a shared vision for the future.

Tip : Ask yourself: Do I enjoy analyzing budgets for group events? If yes, try building a basic Excel model for a hypothetical company valuation using free online templates.”

Ready to explore whether investment banking is the right path?

Don’t leave it to chance — career counselling can help you and your child map out the right education, internships, and certifications to break into this competitive field.

💡 Families often struggle to match a student’s personality and motivators to high-stakes careers like investment banking — where ambition meets pressure. Expert coaching uncovers those hidden alignments, bridging dreams with reality through guided reflection, not guesswork.

Book a Free Career Guidance Session with NextMovez and take the first confident step toward a future in investment banking.

References and Resources

- AICTE Guidelines on MBA and Finance Programs (2024)

- CFA Institute – CFA Program Overview (2024)

- UGC Curriculum Framework for Higher Education (2024)

- LinkedIn Jobs on the Rise 2025 Report

- NASSCOM Future of Finance & Technology Report (2024)

- World Bank Global Financial Development Report (2024)

- RBI Annual Report – Banking and Financial Sector Growth (2024)